editorial-team@simplywallst.com (Simply Wall St)

·4-min read

The German market has shown resilience amidst global volatility, with the DAX index gaining 0.35% despite broader concerns about economic growth. Recent positive industrial output and order data suggest underlying strength in Germany's economy, providing a fertile ground for small-cap companies to thrive. In this context, identifying stocks with strong fundamentals and growth potential becomes crucial. Companies like Südwestdeutsche Salzwerke stand out as undiscovered gems that could offer significant opportunities for investors willing to explore beyond the well-trodden paths of larger indices.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.44% | -1.40% | -8.94% | ★★★★★★ |

EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

Südwestdeutsche Salzwerke | 0.66% | 4.03% | 11.36% | ★★★★★☆ |

HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

ADVERTIsem*nT

Let's explore several standout options from the results in the screener.

Südwestdeutsche Salzwerke

Simply Wall St Value Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG mines, produces, and sells salt in Germany, Europe, and internationally with a market cap of €630.45 million.

Operations: The company's revenue streams include €275.89 million from salt and €61.20 million from waste management, with an additional €18.63 million from other segments. Reconciliations account for a negative impact of -€18.11 million on total revenue.

Südwestdeutsche Salzwerke (SSH) has been a standout performer, with earnings growth of 188% over the past year, significantly outpacing the Food industry’s 21.1%. Trading at 71.6% below our fair value estimate, SSH presents an attractive valuation. Despite increasing its debt to equity ratio from 0.3 to 0.7 over five years, SSH's interest payments are well covered by EBIT (845x). However, its share price has been highly volatile recently, which may concern some investors.

Eckert & Ziegler

Simply Wall St Value Rating: ★★★★★★

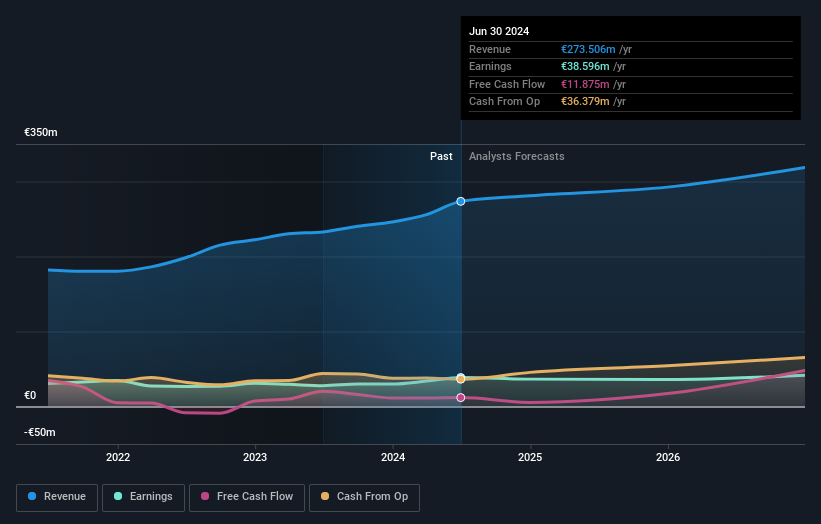

Overview: Eckert & Ziegler SE manufactures and sells isotope technology components worldwide, with a market cap of €889.27 million.

Operations: Eckert & Ziegler generates revenue primarily from the sale of isotope technology components. The company's financial data reveals that it has a market cap of €889.27 million.

Eckert & Ziegler, a notable player in the medical equipment industry, reported robust earnings growth of 38.8% over the past year, significantly outpacing the industry's -6.4%. The company's debt to equity ratio has improved from 14.7% to 9.5% over five years, reflecting prudent financial management. Recent quarterly sales hit €77.76 million compared to €60.03 million last year, with net income rising from €6.17 million to €9.54 million, showcasing solid operational performance and growth prospects.

Click to explore a detailed breakdown of our findings in Eckert & Ziegler's health report.

Explore historical data to track Eckert & Ziegler's performance over time in our Past section.

KSB SE KGaA

Simply Wall St Value Rating: ★★★★★★

Overview: KSB SE & Co. KGaA, along with its subsidiaries, manufactures and supplies pumps, valves, and related services globally with a market cap of approximately €1.10 billion.

Operations: KSB SE & Co. KGaA generates revenue primarily from three segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million).

KSB SE KGaA, a smaller player in the machinery sector, has seen its earnings grow by 16.8% over the past year, outpacing the industry average of 5.6%. Despite a significant one-off loss of €102.5M impacting recent financial results, KSB's debt to equity ratio has improved from 9.2% to 2.1% over five years. The company is trading at a substantial discount of 78.1% below its estimated fair value and remains free cash flow positive despite these challenges.

Delve into the full analysis health report here for a deeper understanding of KSB SE KGaA.

Review our historical performance report to gain insights into KSB SE KGaA's's past performance.

Summing It All Up

Get an in-depth perspective on all 43 German Undiscovered Gems With Strong Fundamentals by using our screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DB:SSH XTRA:EUZ and XTRA:KSB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com